The Austin Housing Bubble

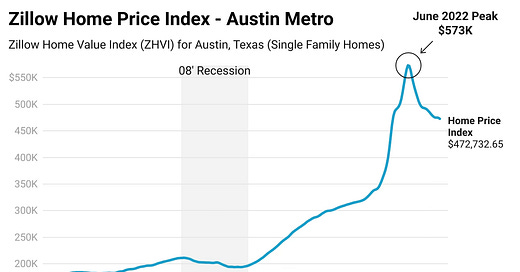

Austin, Texas, epitomizes the post-COVID real estate market, with home prices soaring by 101% from June 2016 to June 2022, sparking fears of a potential bubble.

If there is one city that represents the real estate market in a post-COVID world, it's Austin, Texas. Here, the combination of hype, speculation, and greed has created one of the wildest markets the U.S. has ever seen. America's newest boomtown has attracted billions in investments and tens of thousands of new residents, drawn by its growing tech industry and vibrant cultural scene. But as with all boomtowns, speculation about its market has many experts concerned. From June 2016 to June 2022, home prices in Austin skyrocketed by 101%, sparking fears that it may be at the heart of a massive U.S. real estate bubble.

I the summer of 2022, the typical value for a single-family home in the Austin metro area reached $573,000, capping off two years of parabolic growth. Looking at the line following 2020, you can see it essentially headed straight up. However, after the interest rate hikes, the market took an abrupt turn, with buyers finally waving the white flag, signaling to sellers that such price growth was simply unsustainable.

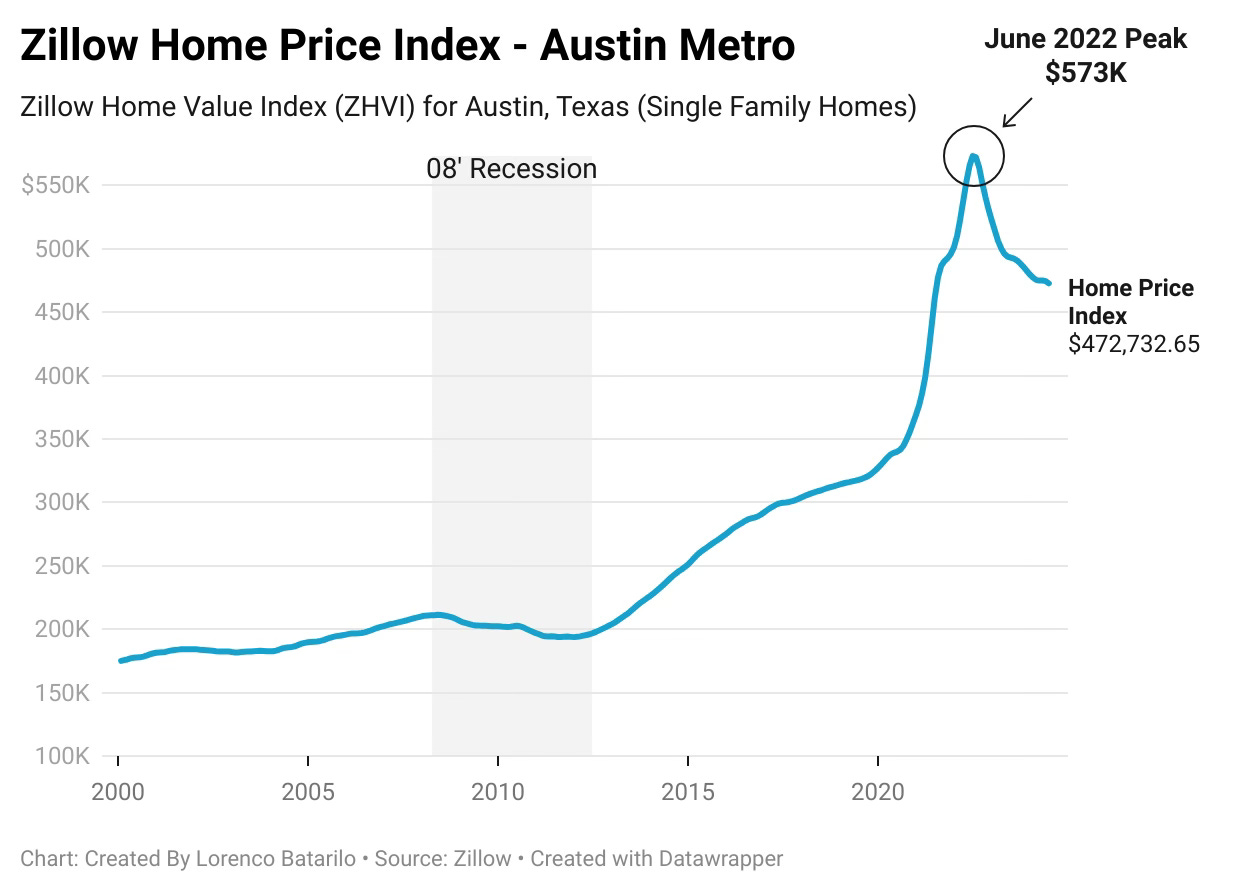

Viewing this through the lens of monthly payments provides a clear illustration of the absurdity that followed the 2020 craze. Assuming a typical buyer puts down 20% and factoring in property tax, insurance, and fluctuating interest rates, the chart below highlights how dramatically the situation has changed for buyers over the past four years.

As recently as August 2020, a typical buyer could expect to pay around $1,700 a month for a typical Austin home. Four years later, that number has surged to $3,243 a month—a 91% increase since the pandemic began. Despite a decrease in home prices over the past two years, monthly payments have remained high due to 7% interest rates, offering little relief to typical borrowers looking to purchase a home.

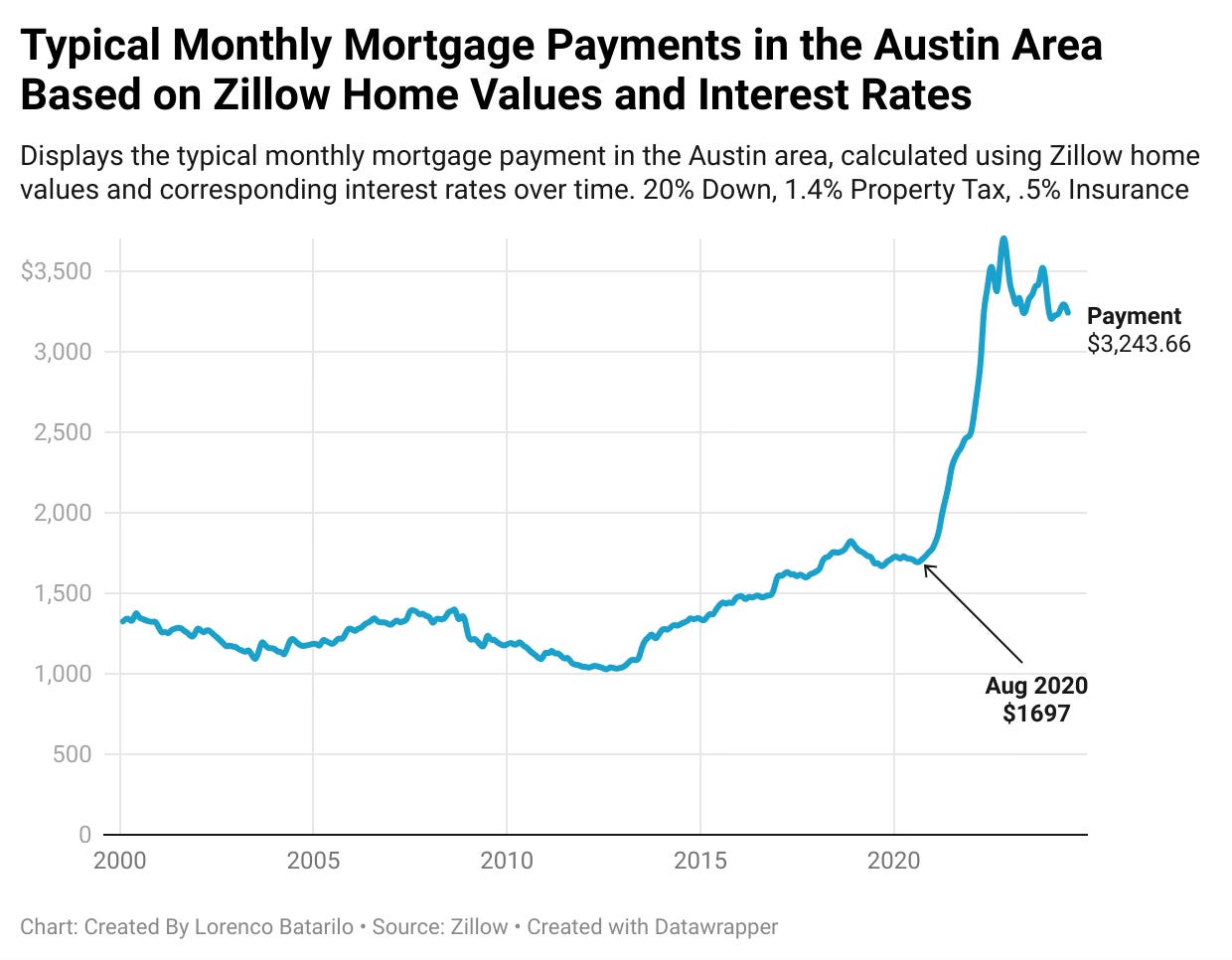

These wild fluctuations have disrupted the market significantly. Following the 2022 highs, Austin has built up inventory unlike any other region in the United States. While other cities have yet to return to their 2019 norms, Austin's inventory levels have surged past pre-pandemic levels.

Based on Realtor.com data you can see that the Austin-Round rock metro has recently exploded in unsold inventory with listings exceeding the 2019 high of 8000. Today the number of active listings sits at 11,000 which is a 38% increase based on those 2019 numbers. In real estate, when supply grows excessively beyond the long-term average, we typically see price cuts and the onset of capitulation for sellers. While the market has already shifted in favor of buyers, the inventory data suggests there may be more challenges ahead. Current prices are unlikely to hold if this inventory surge continues, and the rest of the summer will provide valuable insights into what to expect moving forward.

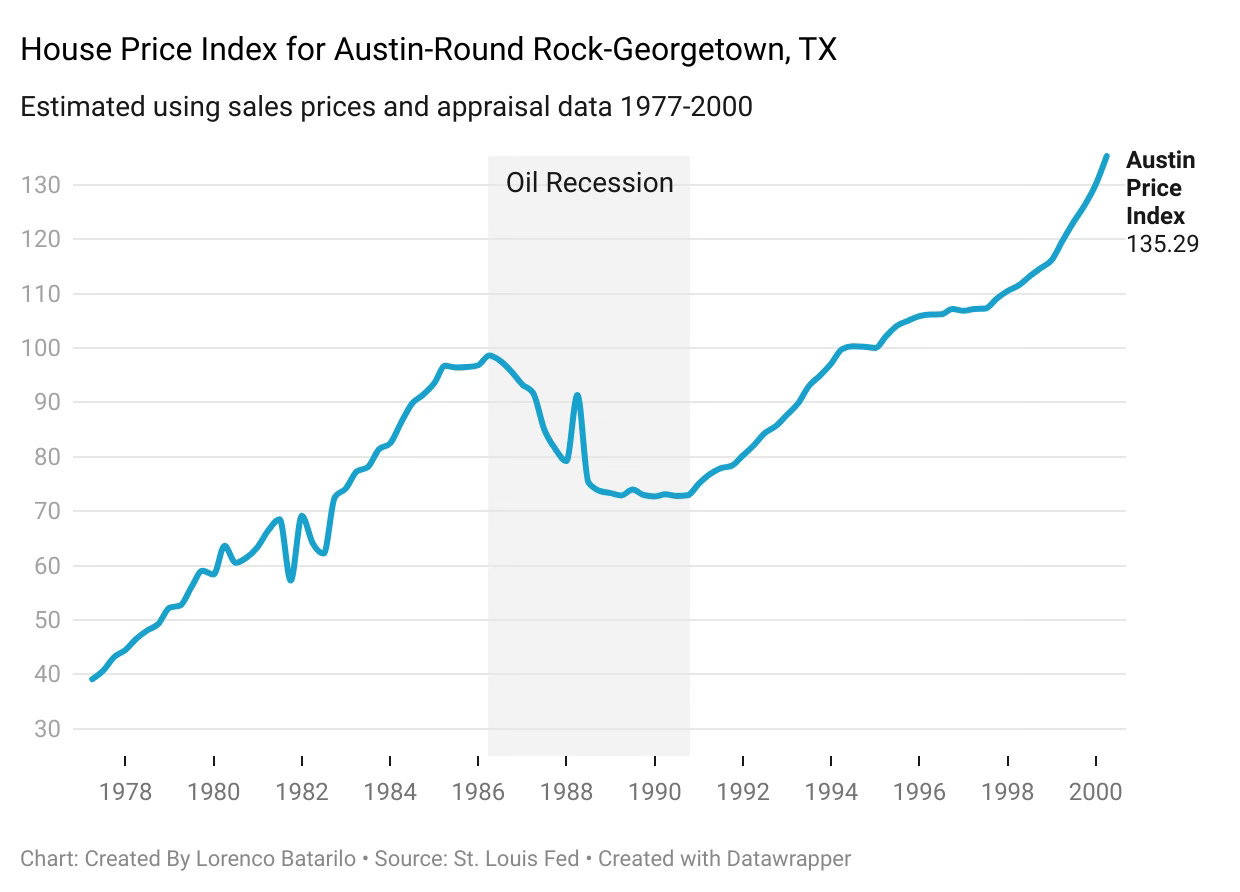

However, this wouldn't be the first time the city has faced a swift real estate correction. While the rest of the nation suffered heavily in the 2007 crash, Austin remained resilient, with prices only falling about 5%. Conversely, in the early '90s, Austin experienced a severe downturn. During a period when the U.S. faced a mild recession, Austin's real estate market crashed due to falling oil prices. With the city heavily reliant on the oil industry, prices plummeted here more sharply than anywhere else in the nation.

The "oil recession" saw prices collapse by 27%, far exceeding the declines experienced during the 2007 crisis. Today, with much of Austin's economy reliant on the big tech industry, there are concerns that a downturn in this sector could trigger another significant drop in home values, reminiscent of the 1980s. For those who bought in 1986, it took until 1994 for their home values to recover. The question now is whether those who purchased homes in 2022 will face a similar prolonged recovery period if the tech sector experiences a continued downturn.